The question “What is BuzzFeed?” has always had a relatively simple answer: whatever its founder and CEO Jonah Peretti wants it to be. During its peak, it was a millennial digital culture factory as well as a Pulitzer Prize–winning news site. Later, after acquiring Complex and HuffPost, it became a sprawling network of videos and other ephemera. Since going public in 2021, though, it has shed most of the sites it had acquired, shuttered its entire news division, and laid off hundreds of employees — all as it reckons with debts that have made BuzzFeed’s future an open question.

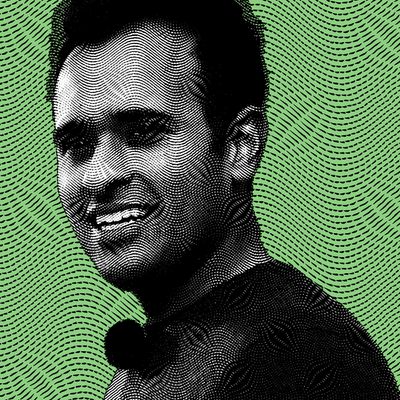

One possible clue about the future came on Wednesday, when Vivek Ramaswamy — the so-called “anti-woke” former Republican long-shot presidential candidate and hedge-fund manager — revealed that he had purchased a 7.7 percent stake in the company. According to a securities filing, he wants to pursue “a shift in the company’s strategy,” which could include talking with “potential acquirers.” The news of his stake sent shares up as much as 55 percent.

The first question is why he would even want to do this. Ramaswamy isn’t exactly the most obvious candidate for taking over BuzzFeed, except that, as an elder millennial, he was once the prime demographic for the site. Peretti’s company, which Donald Trump once called a “failing pile of garbage,” is an unabashedly left-leaning site. The billionaire tennis lover, on the other hand, said the January 6 riot at the Capitol was an “inside job,” and he wrote a whole book about how social justice is a scam (although his own company has a diversity, equity, and inclusion initiative). As an investor, his track record is in pharmaceuticals, not media. He has thought about anti-woke versions of Nike or Coca-Cola, but the idea of a right-wing BuzzFeed seems antithetical to the whole operation.

The second question is how much influence he could actually gain at BuzzFeed. Leaders of tech companies — of which, arguably, BuzzFeed is one — have long used the stock market to consolidate their control and fend off people like Ramaswamy. One way to do this is to issue different classes of shares. At BuzzFeed, there are Class A and B shares, both of which give the owner a stake in the company. The big difference between the two classes is that A shares give the holder one vote on company matters, while B shares give 50 votes. Peretti owns 3 percent of the A shares — the ones with one vote — but 96 percent of the B shares, according to an April filing. This gives him 64 percent control over the company.

Ramaswamy’s stake is entirely in the less powerful A shares, which he bought from March through Tuesday. It’s not clear what percentage of the company he controls, since BuzzFeed has shrunk the number of shares available for trade, but it is somewhere under 2 percent.

Representatives for Ramaswamy didn’t return requests for comment, and he hasn’t made his intentions with the company clear. “BuzzFeed is purposely structured to protect its editorial integrity. We are always open to hearing ideas from our shareholders,” a BuzzFeed spokesperson wrote, after this story first published. The message here from the company seems to be clear: Jonah Peretti is still very much in charge.

This story was updated on May 23 to include a statement from BuzzFeed.