A 70 percent tax on incomes over $10 million isn’t cool. You know what’s cool? A 2 percent tax on the wealth of all Americans who own more than $50 million in assets.

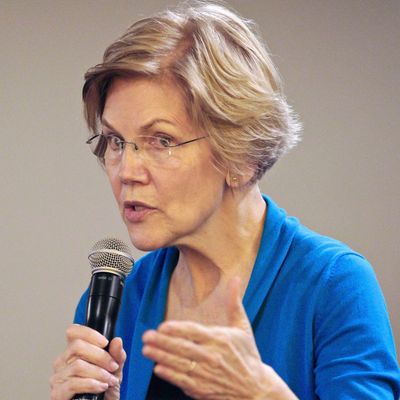

Or so Elizabeth Warren’s policy advisers seem to believe. Weeks after Alexandria Ocasio-Cortez brought expropriating the super-rich’s income back into fashion, the Massachusetts senator is preparing to hit the plutocrats where it hurts — right in the assets. As the Washington Post reports:

Emmanuel Saez and Gabriel Zucman, two left-leaning economists at the University of California, Berkeley, have been advising Warren on a proposal to levy a 2 percent wealth tax on Americans with assets above $50 million, as well as a 3 percent wealth tax on those who have more than $1 billion, according to Saez.

… Warren’s proposal includes at least three new mechanisms to combat tax evasion, according to a person familiar with the plan. Those are a significant increase in funding for the Internal Revenue Service; a mandatory audit rate requiring a certain number of people who pay the wealth tax to be subject to an audit every year; and a one-time tax penalty for those who have more than $50 million and try to renounce their U.S. citizenship.

Taxing assets has many advantages over (merely) taxing income. First and foremost, that’s where the money is. The gap between the one-percent’s annual earnings — and everyone else’s — is large. But the chasm between the former’s holdings and the 99 percent’s is gargantuan. As of 2015, the richest one percent of Americans were bringing home 20 percent of our country’s national income — but commanding 35 percent of our nation’s wealth. Meanwhile, the top 0.1 percent lay claim to assets as valuable as the bottom 90 percent’s combined.

Thus, soaking the rich through wealth taxes will get you a lot of bang for their buck. According to Zucman and Saez’s calculations, Warren’s wealth tax would bring in $2.75 trillion during its first decade — despite affecting only 75,000 of America’s families. There is no way to generate that much revenue from income taxes without digging into the middle-class’s pockets. And polling data suggests that a majority of Americans are eager to support a wide variety of ambitious progressive programs like Medicare for All or a federal jobs guarantee — so long as rich people pick up the tab.

Further, Warren’s policy makes for good messaging. As Boston University political scientist Spencer Piston documents in his recent book Class Attitudes in America, many swing voters believe that the rich “get more than they deserve,” and are inclined to support policies (and parties) that target the wealthy. But Democrats have often failed to capitalize on widespread resentment of the rich in the past by neglecting to deploy populist rhetoric that would convey the distributional implications of progressive policy goals. For example, Piston shows that support for the estate tax surges when voters are made to understand it as an inheritance tax on the super rich. The distributional implications of a tax on $50 million fortunes will be harder for Republicans to obfuscate than those of a 70 percent top marginal tax rate (marginal tax rates being a concept that many voters do not immediately comprehend).

And yet, trying to spread the wealth around also has its downsides. First, it’s a lot harder to tax assets than it is to tax income because the former are easier to hide, and their value is harder for Uncle Sam to assess. In 1990, eight OECD countries had wealth taxes; today, only four do. The abandonment of such taxes may reflect a rightward drift in economic policy over the past 29 years. But it’s also the case that these taxes have tended to bring in less revenue than their boosters had hoped. Meanwhile, the more money the wealthy spend on tax-evasion services, the less capital they collectively invest in things that have some social utility (like enterprises that create jobs or value for consumers).

All this said, the United States isn’t an ordinary country. It is the wealthiest nation in human history — and, for at least a few more years, the closest thing this planet has to a hegemonic power. If the U.S. took policing global tax evasion as seriously as it took policing global terrorism, it’s hard to believe that it couldn’t make asset taxation at least somewhat viable.