The United States has never been richer. In 2018, American households boasted a collective net worth of over $98 trillion. If that wealth were divided evenly across the U.S. population, every human being in our country would have roughly $298,000 to their name — and every family of four would be millionaires.

Few Americans feel entitled to full communism. But many do have trouble reconciling their nation’s unprecedented wealth with the increasing insecurity of middle-class life. In the 1960s, economists worried that 21st-century Americans would struggle to find purpose once economic progress turned full-time employment into an archaic chore practiced solely by the eccentric, like churning butter or collecting CDs. And yet, in 2019, middle-class Americans are working harder than ever. We were promised flying cars. Instead, we got 60-hour workweeks.

So, what went wrong? How did we miss the exit for fully automated comfort-plus capitalism?

This week, an excellent New York Times feature titled “The Middle-Class Crunch” shed some light onto these questions by dissecting the finances of four model middle-income families, and by illustrating the macroeconomic trends that undergird their disparate struggles.

After reading the Times’ report and other recent analyses of our postindustrial discontents, I’ve come to think that the decline of America’s middle class can be attributed to three distinct (though related) policy failures. Namely, the failures to sustain American labor’s bargaining power; to contain rent-seeking in the housing, health-care, and higher-education sectors; and to update (and expand) the social-welfare state for the 21st-century economy.

1) We let wages fall too damn low.

This one is the most familiar (and, as an explanation of middle-class decline, arguably tautological). Nevertheless, it’s worth briefly reviewing the grim facts about working-class wage stagnation in the U.S. and how it came to be. From 1948 to 1973, the median worker’s hourly compensation rose in tandem with productivity. Which is to say: As innovation enabled the U.S. economy to extract more value per hour from the typical worker’s labor, it also enabled that worker to secure a higher rate of compensation. In the disco era, America was 96.7 percent more productive than it had been in 1948, and the median American worker was 91.3 percent better paid than her postwar analogue.

But then, times changed. Between 1973 and 2013, America’s labor force became 74.4 percent more productive — but the median U.S. laborer’s paycheck grew just 9.2 percent fatter.

On one level, it’s a bit unfair to describe this development as a policy failure, since it was at least partly intentional. Amid the stagflation crisis of the 1970s, a consensus formed among policymakers that the excessive bargaining power of American workers had broken the economy. Unionized laborers had secured compensation in excess of their marginal productivity, which had forced firms to raise prices, which had led those workers to demand further wage increases, which had led to further price hikes, which had led to even more excessive wage demands, in an inflationary spiral. Beyond taking a toll on price stability, the greed of our working class was also enabling foreign competitors to eat corporate America’s lunch. The New Deal bargain might have worked in an era when Japan and Western Europe lay in ruins and American capital reigned supreme. But with Japanese and German industry ascendant, the U.S. could no longer afford to coddle its proletariat. Thus, to get a handle on inflation, protect the U.S. dollar, and restore our firms’ global competitiveness, wages would have to go down. Or, as Federal Reserve chairman Paul Volcker put it in 1979, “The standard of living of the average American has to decline.” To that end, Volcker engineered a recession by raising interest rates to unprecedented heights. This policy had its intended effects; many a worker’s will and union were broken. Inflation was licked.

But Ronald Reagan’s election ensured that the war on workers would persist even after price stability was restored. His firing of the PATCO strikers signaled that Uncle Sam no longer frowned on union-busting. Corporate America kicked its class war into a higher gear. Over the ensuing decades, as automation and globalization reordered the U.S. economy — and shrank the heavily unionized manufacturing sector — policymakers in both parties did little to nothing to facilitate the expansion of collective bargaining into service industries. As a result, America’s unionization rate fell by more than half between 1980 and 2018. This development, combined with a monetary policy that continued to prioritize low inflation over full employment, largely explains the decline in labor’s share of productivity gains.

Some may reject this analysis on the grounds that the stagnation of middle-class wages in the U.S. is the result of ineluctable economic forces. After all, in recent decades, such stagnation has been ubiquitous throughout developed countries, despite their profoundly different policy environments and rates of unionization.

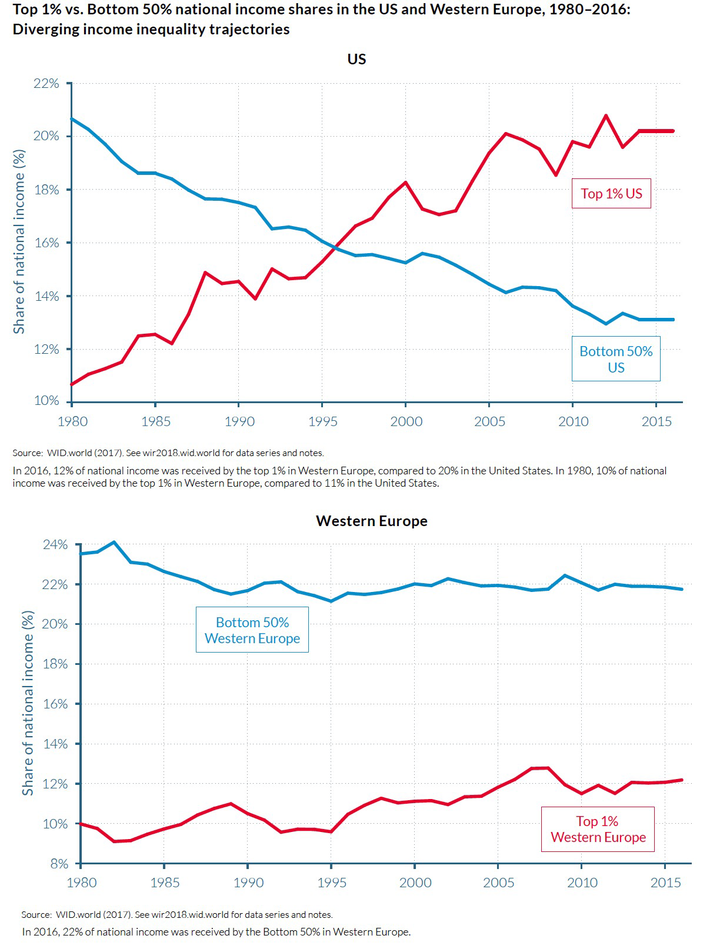

There are a lot of problems with this argument. But the most fundamental is that America’s workers have suffered a far greater setback than their Western European peers. Between 1995 and 2013, labor’s share of national income in the U.S. dropped by 8 percentage points, a steeper decline than in any other nation except for South Korea and Poland, according to a 2018 OECD report.

And the American capitalist class has been claiming an exceptionally high share of national income for much longer than just two decades — as this stunning chart from the 2018 World Inequality Report makes clear:

All this said, tepid wage gains are still wage gains. If eviscerating workers’ bargaining power had been our policymakers’ only sin, America’s contemporary middle class would enjoy more economic security than its predecessors. Unfortunately:

2) We let the costs of housing, health care, and higher education rise too damn high.

If you’re already growing tired of skimming this article — and are willing to settle for a partial understanding of the American middle class’s predicament — this chart from the “The Middle-Clash Crunch” will tell you 95 percent of what you need to know:

The neoliberal era has scored American households cheaper groceries and electronics. But it’s also enabled extractive interests in the health-care, housing, and higher-education sectors to bleed middle-income families dry.

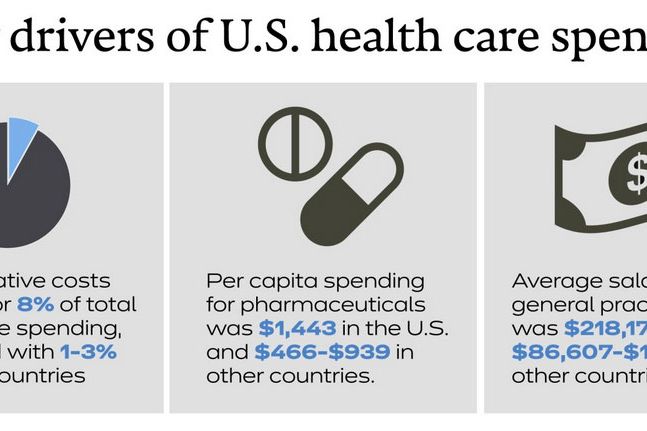

The health-care industry may be our economy’s most ravenous parasite. Due to our central government’s exceptional refusal to combat rent-seeking in the medical sector through price controls, the United States spends several times more than similar nations on health-care administration, pharmaceuticals, and physicians’ salaries. In return, Americans enjoy the 29th best health-care system in the world (just behind the Czech Republic’s), according to The Lancet.

To appreciate just how thoroughly we’re being ripped off, consider our neighbors to the north. In 2018, Canada spent roughly 11 percent of its GDP on health care, which was enough to provide all of its citizens with premium-free access to the world’s 14th-highest-performing health-care system. That same year, the United States spent roughly 18 percent of its GDP on health care — which, in our system, was not sufficient to provide any form of insurance to nearly 30 million Americans, nor to prevent more than 50 percent of our people from delaying or forgoing medical care due to affordability concerns.

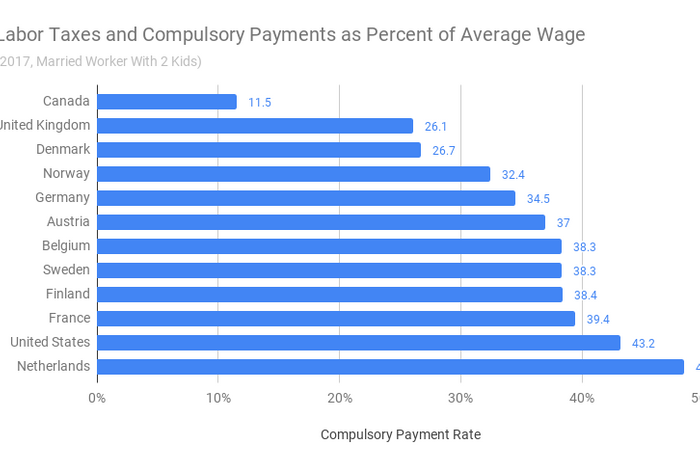

A common misconception about the American political economy is that U.S. workers are lightly taxed. The Europeans may have a plusher safety net, the story goes, but at least we get to keep more of our take-home pay. But this is only true if one regards health insurance as a discretionary expense, which is not how the vast majority of adults in developed countries see it. And once you stipulate that insurance premiums function effectively as taxes on labor in the United States — which is to say, as (de facto) compulsory payments deducted from Americans’ paychecks to finance social insurance — then American workers’ labor income is taxed at one of the highest rates in the OECD. As Matt Bruenig of the People’s Policy Project has shown:

In other words, the American middle class is already taxed like Europe’s. But instead of buying us universal health care and other forms of social protection, our paycheck deductions go toward sustaining redundant private-insurance bureaucracies, Big Pharma’s high profit margins, and American doctors’ extraordinary salaries. We aren’t choosing to put “small government” above social welfare. We are choosing to be ripped off.

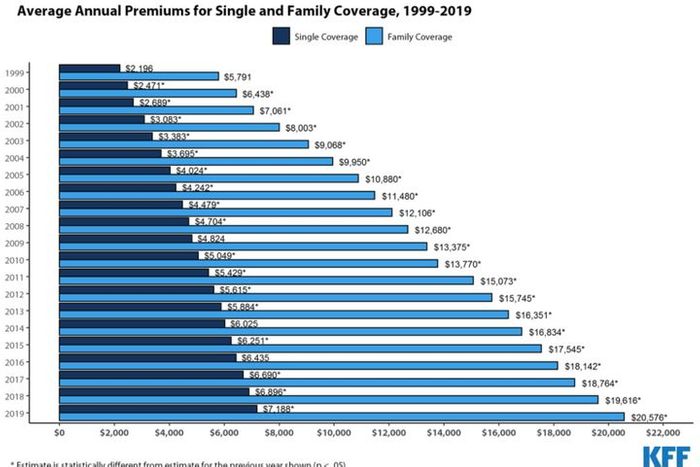

And the costs of our government’s refusal to confront the health-care lobby grow higher every year. In 2019, the average annual premium on an employer-provided family health-insurance plan is $20,756 — 54 percent higher than it was just ten years ago. This form of inflation not only increases Americans’ out-of-pocket health-care costs but also depresses their wages; the more employers need to spend on their share of premiums, the less they can provide in direct compensation.

A similar dynamic prevails in America’s higher-education system. A 2018 OECD report found that the U.S. spends more per student on higher education than any developed country save Luxembourg. A wide variety of factors contribute to America’s outsize college spending. But the primary one is the same basic policy failure that’s breaking our health-care system. As The Atlantic reported last year:

“The U.S. is in a class of its own,” says Andreas Schleicher, the director for education and skills at the OECD, and he does not mean this as a compliment. “Spending per student is exorbitant, and it has virtually no relationship to the value that students could possibly get in exchange.”

… Ultimately, college is expensive in the U.S. for the same reason MRIs are expensive: There is no central mechanism to control price increases. “Universities extract money from students because they can,” says Schleicher at the OECD. “It’s the inevitable outcome of an unregulated fee structure.” In places like the United Kingdom, the government limits how much universities can extract by capping tuition.

Finally, restrictive zoning on the local level — and policies that favor homeowners over renters and foster asset-price inflation on the federal one — have enabled landlords (and longtime homeowners who sell their properties) to extract a rising share of middle-class workers’ earnings, especially in the nation’s most prosperous metro areas. As the Times notes, the average U.S. household now devotes 33 percent of its expenditures to housing, up from 27 percent in 1950.

3) We let our social-welfare institutions (such as they are) grow too damn outdated.

After helping bosses drive down middle-class wages — and landlords, hospitals, insurers, and college administrators heavily garnish what remained of its take-home pay — the least policymakers could do was update America’s (meager) social-welfare institutions for the modern age. Alas, despite some modest efforts by Democratic administrations at the state and federal levels, our political class as a whole has failed to clear this threshold.

The New Deal bargain that briefly brought a pale facsimile of social democracy to the United States was built around several outmoded premises that no longer hold. Chief among them: that the corporate sector would provide middle-class workers with social benefits akin to those doled out by the state in European nations and a “family wage” that would enable middle-class women to either stay home or work part time so as to provide the services necessary for social reproduction. Of course, not all middle-income Americans were cut in on this deal (nor were most lower-income Americans). And its prevalence is often exaggerated in pop-culture depictions of the period and thus in popular memory. But it remains the case that, for many millions of middle-class Americans, this social contract provided a robust degree of economic security.

The past four decades have rendered that contract null and void. One aspect of this development merits celebration — through political mobilization, women have secured greater autonomy and freedom in their economic lives and have therefore drastically increased their participation in the workforce. But as the Times’ report suggests, this jump in women’s working hours wasn’t driven solely by female empowerment; the necessity of compensating for male wage stagnation or decline was also ostensibly a factor:

From 1979 to 2018, middle-income families’ incomes rose 23.1 percent, adjusted for inflation, according to the study. Professional families’ incomes, by contrast, rose 68.3 percent. Over the same 39 years, the average American woman experienced a 21 percent increase in annual working hours, according to [chief executive officer and president of the Washington Center for Equitable Growth economist Heather] Boushey’s analysis.

Most of the earnings gains among families in the period Ms. Boushey studied can be traced directly to working women. They accounted for three-quarters of the rise in income among middle-class families in that time. Among professional families, women’s earnings were the most important factor, but men’s incomes rose, too.

“Many families would have seen their income drop precipitously over the past few decades if it had not been for women going to work,” Ms. Boushey said.

Women’s growing economic participation has made a massive contribution to our collective prosperity. But it has also made America’s aberrant lack of family-welfare policies — such as public day care, child allowances, and paid family-leave benefits — even more conspicuous and burdensome for middle-class households.

Meanwhile, U.S. employers have gradually withdrawn from the “Treaty of Detroit,” lowering the benefit standards many embraced in the postwar period, either by leaning on contract laborers instead of employees or simply downgrading their offerings. As the Times writes, “Pensions have been largely replaced by 401(k) plans. Comprehensive health coverage has given way to high-deductible plans.”

Like women’s heightened labor-force participation, the decoupling of social provisions from employment could have been an entirely positive development — if Uncle Sam had stepped in to pick up the slack. But it didn’t. The disappearance of the defined-benefit pension plan coincided not with increases in Social Security benefits but rather with effective cuts to such benefits. And the rise in women’s working hours did not coincide with the establishment of universal public child care but rather with soaring private child-care costs.

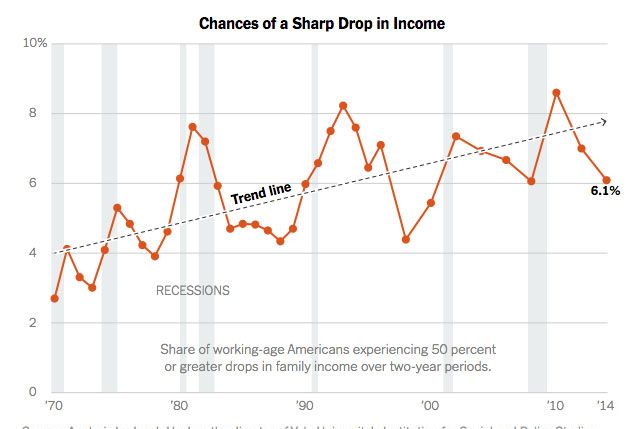

As a result, economic life for the American middle class has grown more volatile and insecure, with sharp drops in annual income becoming an increasingly common experience.

In sum: The “middle-class crunch” is a choice. The American Dream isn’t dying of natural causes. We know what must be done to revive it. The problem is simply that a lot of powerful people would rather pull the plug than pay for the cure.