The president would like you to know that the economy is amazing, “very strong,” “the best in the world, by far” with the “lowest unemployment ever in almost all categories.” The vice-president says “our economy is thriving, and Americans are winning.” Commerce Secretary Wilbur Ross says “American companies and workers are succeeding together” because of Trump’s policies. If you hear the economy is in trouble, Trump says, that’s just because the media is trying to will the otherwise-strong economy into a recession. Don’t believe their fearmongering!

The president would also like you to know that extraordinary measures are desperately needed to prop the economy up. The Federal Reserve should quickly cut short-term interest rates by at least 100 basis points, he says, and perhaps even resume quantitative easing, its extraordinary program of buying long-term debt to reduce long-term interest rates that the Fed used in its efforts to recover from the Great Recession. He is also considering a payroll tax cut.

All these statements are from within the past three days.

So which is it? If the economy’s really so shockingly strong, why would the Fed need to cut rates? Shouldn’t it be raising them since the roaring Trump economy is sure to cause the labor market to overheat? Why would this be the time to cut payroll taxes if companies are already so eager to hire workers?

This contradiction is likely the reason unnamed White House officials were so eager to stomp on rumors the president would push for a payroll tax cut — a stomping effort he undermined today by going to the media and saying the rumors are true and he is in fact looking at a payroll tax cut. If Trump really wants a politically divided Congress to cut taxes again, he’s going to have to explain why. And that conversation isn’t going to go great for him, since it will require admitting the Trump economy is fragile enough to necessitate extraordinary policy efforts to keep it growing.

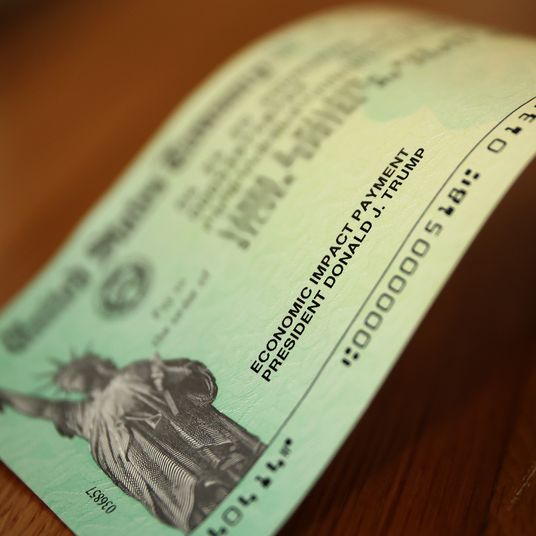

The why of the payroll tax cut would presumably be the same as the why when Congress last did a temporary payroll tax cut in 2011. The point of the policy would be to stimulate the economy by putting more money in consumers’ pockets and reducing the disincentive that taxes on labor income create for working and hiring. There are reasons to think that wouldn’t work as well at this point in the cycle as it did in 2011 — the labor market is already a lot stronger now — but that is, in general, why you do a payroll tax cut.

But if you ask for a new tax cut, that leads to an obvious question: Just last year, we got a tax cut that was supposed to grow the economy. Why are you back to ask for another one? Why didn’t your last tax cut work like it was supposed to?

Then there is the matter of the demands the president would have to address.

Democratic lawmakers are unlikely to want to hand any political win to the president. They also worry about how payroll tax cuts would affect entitlement programs: While trust-fund accounting is more legal fiction than economic fact, proceeds from payroll taxes are in theory supposed to be earmarked for Social Security and Medicare Part A. This concern can be addressed (the 2011 bill had provisions to make the trust funds whole from other revenue), but it’s a reason Democrats will require incentives to go along even with a middle-class-focused tax cut.

There is an obvious response for Democrats to make to this pitch: Yes, we agree that your last tax cut sucked and isn’t boosting the economy like it was supposed to. Unfortunately, your tax cut used up the fiscal space one would hope to use for a policy like a payroll tax cut. So we will agree to cut payroll taxes if the tax cut is financed by repealing tax cuts you gave to rich people and businesses, which unfortunately do not seem to have produced the economic benefits you had hoped for and promised.

And there would be problems on the other side of the aisle. Republican lawmakers love tax cuts, but payroll tax cuts are not their favorite kind of tax cut. They are more inclined to believe tax cuts on capital income boost growth (some economic research does indeed suggest capital investment is more responsive to tax rates than the labor supply is), and wealthy Republican donors stand to benefit only very modestly from a cut in Social Security taxes, which apply only to the first $132,900 of labor income. So while Republican lawmakers could conceivably be dragged into supporting a stand-alone payroll tax cut if Trump really wanted it, they couldn’t be dragged into making the offsetting concessions that Democrats would demand be attached to such a tax cut.

So this conversation wouldn’t lead to a payroll-tax-cut deal, but it would highlight several negative stories about the economy for the president. First, despite what he says, he is nervous about the economic trajectory. Second, his tax cuts haven’t produced the growth he said they would. And third, his tax cuts have made it more difficult for Congress to implement other policies he says are necessary.

Of course, the president has a tendency to muse about tax cuts with no intention of delivering them. He said shortly before the 2018 elections that a plan for a 10 percent tax cut on the middle class was forthcoming. It was not forthcoming. I do not expect the president to get into a protracted legislative negotiation in search of a payroll tax cut.

The president can continue to harass the Federal Reserve on Twitter for rate cuts, though, as I’ve written before, the Fed seems to be mostly responsive to financial-market conditions, economic data, and substantive economic damage caused by the president’s policy agenda, not to his tweets. I think it is very unlikely he will get his 100-basis-point cut unless the economy really turns south in a way that would make such a cut more than warranted.

If the president wants to improve the economic outlook, the best tool available to him is the one he can wield unilaterally, or rather stop wielding: He can end the trade wars. A significant de-escalation with China wouldn’t make a recession impossible, but it would make it a lot less likely.