Earlier this year, an Arizona man came off of his shift at a restaurant to find his 2006 Ford Focus gone, suddenly repossessed after he and his wife fell more than 60 days behind on their loan. In Missouri, another worker went to turn on his 1997 Sunfire but found it would not start. He was behind on his payments, so collectors turned his engine off with a starter-blocking device. Read the local papers, and you will find hundreds more stories just like that, along with tales of car dealers flogging no-income-verification loans, debt collectors harassing families with phone calls, and families losing their rides.

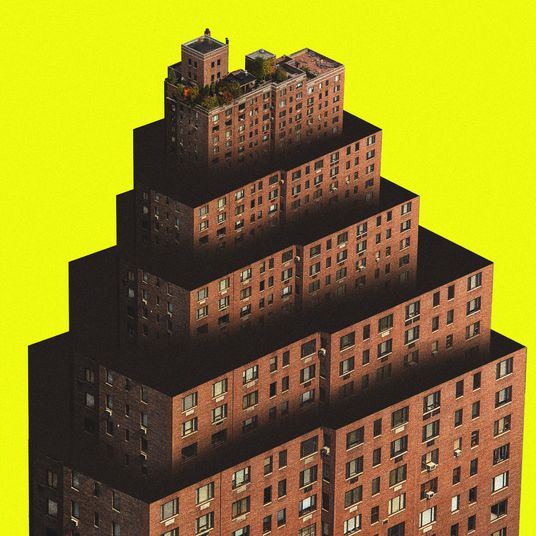

These are the all-too-familiar symptoms of a lending market gone a little sick. Consumers are loading up on debt to buy assets that they in many cases cannot afford, goaded on by financiers. That debt is getting securitized and sold off into the financial ether at a breakneck pace. If it is not a bubble, it is a market that seems to be lathered up with froth. Just six years after pitching the country into a financial crisis, subprime loans are back.

For houses and credit cards, lenders remain hesitant to push money out, and credit remains tight. But when it comes to auto loans, it feels like the go-go years of the mid-2000s all over again. According to statistics from the New York Fed, American consumers took out more than $100 billion in new car loans in the second quarter of 2014, the most since 2006, and outstanding balances on all car loans climbed to a record high of nearly $1 trillion.

Companies are feverishly competing to bring in buyers, extending the length of loans and providing ample cash to less-than-ideal borrowers. Auto loans for individuals with credit scores below 620 have grown faster than those for any other group, the Fed found. And alternative auto-financing companies, not banks or credit unions, have seen the biggest surge on their books.

But the consumers buying those cars have not seen big raises over the course of the past few years, and there are signs the market is starting to sour. The proportion of borrowers who were 60 days or more behind on their loans has climbed about 9 percent over the past year. Repossessions have jumped 70 percent. “We’re at a turning point,” wrote Amy S. Martin of Standard & Poor’s in a research note, saying that lenders “expect losses to trend upward.”

Other analysts, like Jerry Podczaski of Experian, argue that might not be something to worry about. Lending to borrowers with subpar credit took a huge nosedive during the recession. It follows that lending to borrowers with subpar credit would have a big bounce-back in the recovery. And more loans means more defaults.

Still, there’s evidence that the quality of loans being made is poor, even for subprime, and that underwriting standards have deteriorated. A 60-year-old guy who has been retired since 1991 and lives on Social Security got more than $15,000 from Wells Fargo, for instance, admitting to the New York Times, “I am not sure how I got the loan.” Worse — much worse — there is evidence that the markets are not pricing the risky assets appropriately. Spreads between prime and subprime-rated auto debt have narrowed. And investors have less insight into the quality of the underlying loans than they do with mortgage debt, in essence making blind bets in a fevered search for return.

That points to the real issue with whatever is happening in the subprime auto loan market: that it hints that investors and lenders might have forgotten the lesson doled out by the collapse of the mammoth housing bubble just a few years ago.

Granted, cars are not houses, and car loans are not mortgages. The market for auto loans is less than a tenth the size of the market for mortgages, after all, and buyers have never seen used cars as investments that would never lose value. And this time, the media, credit-rating agencies, business analysts, and regulators are paying attention. The Office of the Comptroller of the Currency, a primary banking regulator, has noted that it “sees signs that credit risk is now building,” also drawing attention to a “loosening of standards and increased layering of risk in the indirect auto market.” The Federal Trade Commission has cracked down, as have the Justice Department and the Consumer Financial Protection Bureau.

But it still feels a little like 2004 or 2005 all over again, if in miniature, and all too soon.