This article was featured in One Great Story, New York’s reading recommendation newsletter. Sign up here to get it nightly.

The first time it happens, you’re surprised. One day, your friend with the roommates and the wobbly employment and the busted phone — they buy an apartment. They tell you they’re moving, then they admit they’re buying, and suddenly you’re standing in the living room they own. It’s not that you’d never talked about money, if you count the years spent passing $17 back and forth on Venmo; it’s just that you thought you were on the same track. That when you said “broke,” you understood it to mean the same thing. It’s as if you were both paddling aimlessly in New York’s sea of downward mobility when your friend burst out of the water and stumbled onto the beach.

The source of the apartment is not a mystery. It’s parent money. When the job is nonprofit and the trips European, when the work is too freelance and their kids’ school too private, when they close on a co-op before they finish their dissertation, sure, it could be crypto. It could be sex work. Maybe you missed that time they were hit by a city bus. But if you know someone under 50 who’s living like it’s the ’90s — who owns their apartment, who’s out every night, or who sends their kid to private nursery school and still has money left for vacation — it’s safe to assume there’s a baby-boomer behind them. More than at any other time in New York’s history, parent money shapes our culture. It’s in the restaurants started by big-pharma heirs and the fashion line that descends from Flushing real estate. It’s in the magazines with no ads and the white-cube galleries run by 20-somethings. Unlike nepotism, which favors industry loyalty, the recipients of parent money can often choose their own adventure. I used to wait tables at a dirtbag vegan diner in Williamsburg; the owner’s southern family, people whispered, was in munitions.

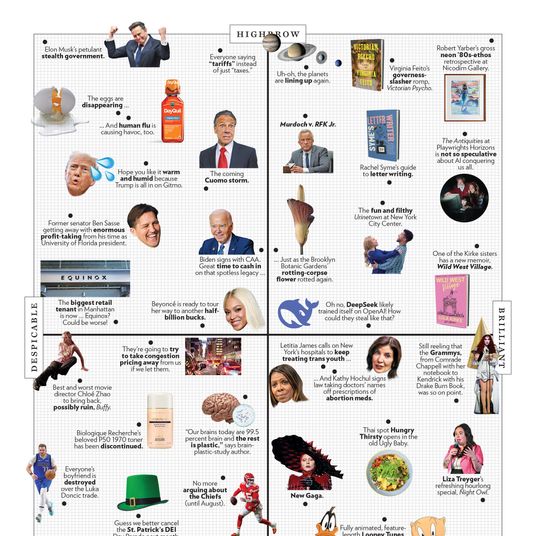

In This Issue

New York has always been stuffed with rich kids chasing the dream on Daddy’s dime. However, it didn’t always feel as if those were the only people who could live here — as if the whole city bent to the budgets of the secretly funded. It does feel that way now because we’re living through a catalytic overlap: Rent prices are shooting up, salaries are not, and boomers are preparing to die. While they are being called the wealthiest generation ever to have lived — the right-place, right-time winners of both the housing and stock markets — their children are stalling out, scraping their flatlining bank accounts to pay rents that, in Manhattan, now average over $5,000 a month. Studio apartments sell for more than half a million. Full-time day-care tuition can run you $40,000 a year. For a lot of New Yorkers who are Gen X on down, markers of adulthood like buying a home, starting a business, or having a kid have gone from aspiration to fantasy — unless they’re lucky enough to benefit from a process financial analysts are calling “the Great Wealth Transfer”: the $124 trillion in assets that, over the next two decades, older generations will hand down to charities and, most of all, to their heirs.

It sounds enormous, epochal, game changing. And it will be, but not for most of us — over 50 percent of that $124 trillion is in the hands of the top 2 percent. There are no firm numbers for how much of the Great Wealth Transfer will begin or end in New York. But since it is the wealthiest city in the world, with some 360,000 millionaires, “you would imagine that’s more inheritors, too,” says Chayce Horton, a senior analyst at Cerulli Associates. “They’re going to be living different lives from people whose parents don’t have that wealth, but they’re still living in the same world. They’re bidding on the same houses. They can handle higher rent. When people ask, ‘Who can afford this?,’ part of the answer will be people who have parents who have money.”

It is impossible to account for all the money, to see where it goes and how it’s spent. If the boomer parents are still alive, they tend to give in bits and pieces: Monthly deposits in a bank account, a paid-off credit card, a vacation, a therapy bill, a tuition payment, a no-interest loan. The boomers keeping the city afloat aren’t all Tisches and Zwirners. Some were teachers, dentists, and city employees who benefited from cheap housing, a strong market, and maybe even a pension. Likewise, many of those getting parent money won’t look rich. If you believe that being middle class means owning a modest home, they will look middle class — until you find out how much that home costs. Since one of the most common ways for parents to give money is through real estate, Realtors have a front-row seat to who’s getting how much. “Homeownership is sort of the capitalist report card, right?” says Corcoran agent Andrew Schwartz. “If you have made it to a level where you can purchase a home, especially here, then that’s the hallmark of success in our society. But when push comes to shove, someone who isn’t generationally wealthy probably cannot buy a property in New York City.” In seven years of working in the industry, Schwartz has yet to see a first-time homebuyer who can close on a property without their parents’ help. Not only are the prices massive — the average for a Brooklyn condo last year was $1.3 million; for a brownstone, $3.3 million — but the mortgage rates are too, meaning more people even considering buying are doing it in all cash.

It wasn’t always this way. Longtime real-estate agent Louise Phillips Forbes says her first transaction, in 1989, was a one-bedroom on the Upper West Side for $63,000 — the equivalent of about $157,000 today. (A similar unit in that building sold recently for $730,000.) In the late ’90s, Jessica Cohen, who’s now a real-estate agent, used $10,000 in savings to put a 10 percent down payment on a studio apartment; she was fresh out of college but says she did it without her parents. “I had saved that from living at home and working my $5-to-$7-an-hour summer jobs,” she says. While agents who worked in the ’80s remember parents helping their kids buy homes, they also remember it wasn’t the default. The agent Paul Bologna says wealthy parents became more visible in the mid-aughts, especially in the New York rental market where he worked; rents outstripped entry-level salaries, and tenants found it harder and harder to satisfy landlords’ income requirements. If a tenant didn’t make enough on their own, they either had to find a cheaper place or get a guarantor — and more often than not, the guarantor would be a parent. If you had a rich one (or your roommate did), you were at a huge advantage for clinching an apartment. “Now those parents who were guarantors are the same baby-boomers helping make purchases,” says Bologna.

While parents of all income levels try to help their kids, in New York it’s a matter of scale. As the financial planner Ally Jane Ayers puts it, if your parents can give you only $10,000 for your down payment on a New York apartment, “it’s like Grandma saying, ‘I’m gonna give you a gift for your birthday,’ and it’s 20 bucks.” (What would really be helpful, she says, is $300,000.) Luca DiCiero, a real-estate broker based in Astoria who specializes in commercial leases, estimates that about 20 to 25 percent of his clients are first-time business owners, often in their early 30s and almost always backed by their parents. Commercial landlords may want to see a year’s worth of rent (plus security deposit and build-out costs) sitting in a tenant’s bank account before they write up a lease; if rent is $6,000 a month and construction costs more than $100,000, it’s a huge load to carry without investors — or the obvious alternative. “My clients will typically try to keep their parents away,” he says. “But there are instances where they’ve said, ‘Look, I’m going to need final approval from my parents to start my new restaurant or my distillery or my, you know, empanada concept.’”

Realtors paint today’s New York as a city of heirs. DiCiero’s always meeting parents from Connecticut, the Hamptons, and the Gold Coast of Long Island. Meanwhile, the residential brokers are seeing out-of-towners buying in the West Village for their college-age children, reasoning it out as an investment or their own future pied-à-terre. Thirty-somethings are touring apartments where their only input is saying whether they can see themselves living there. (Their parents will handle the rest.) Schwartz recalls a particularly well-employed couple — one person was in finance, the other in health care — whose parents still swooped in at the last minute to cover the purchase price.

Of course, few young people are buying property at all right now. Of all Manhattan real-estate purchasers last year, first-time homebuyers made up the smallest percentage in a decade. Nearly a quarter of New Yorkers live below the poverty line, double the national rate. Many, many more may not be considered poor but struggle to cover more than the basics; in New York, a $100,000 salary is considered middle class. Last year, liberal think tank the Urban Institute introduced a measurement called the True Cost of Economic Security, which factors in the specific cost of living in different areas around the country to calculate how many people are not just barely getting by but meeting an income threshold that will let them live sustainably — or, as the researchers put it, thrive. Over 60 percent of New Yorkers do not meet the threshold. Of families with children, it’s 72 percent. And they would need to be making a lot more to get there: On average, for New Yorkers, that would mean an additional $40,000 a year.

Parent money helps maintain a standard that makes no sense. We are living in a city that assumes, requires, and depends on the idea that every salary be augmented by a secret stash of funds. Those who do get parent money are loath to admit it. Some of them see it as a personal failing, like they should be able to hack it on their own. “Shame is the biggest theme I see with my clients when it comes to getting monetary help from their parents,” says Ayers, who works with a lot of millennials. “I mean, I’ve had clients wait till the second or third meeting to disclose it. If they’re a couple, it’s the sideways glance, this kind of silent communication, and slowly the words start to spill out: ‘Well, we should tell you that so-and-so’s parents have promised to help us with this down payment.’” Schwartz recalls a couple who tried to get past a co-op board with their own finances, which he thought looked a little too “thin”; when he pushed them on it, they owned up that their parents could help them out. “They were like, ‘There is other money available to us, but we didn’t want to talk about it’ — meaning they didn’t want the board to think, Oh, here comes a pair of trust-fund babies riding on their parents’ coattails,” he says. “Broadly speaking, that’s how people want to be presented: They want this to look like they’re doing it by themselves.”

It’s time to admit the truth. Over the past few months, New York interviewed people living in the city about something they won’t even discuss with their friends: that their lives have been shaped by parent money. Many express a fear of judgment. A musician whose family is as dysfunctional as it is rich is tied in knots over how his peers will perceive him: “It kind of sets you apart in a way that you don’t decide.” As I talked to New York–based friends and colleagues about this topic, most of them people who were from New York or had been living in the city for years, I watched the feelings move unbidden across their faces — an untapped well of class resentment, a burble of privileged shame. A younger colleague who recently arrived in the city told me about some acquaintances of her boyfriend, four messy boys in their early 20s living in a two-floor penthouse in Nolita. Chandeliers loom from the ceiling. Bedrooms have private terraces. And the rent is $14,500. One of the boys’ parents, a successful actress and a media executive, were paying for most of it. “I only moved here in September,” said my co-worker. “And I’m already like, How long can I afford to stay?”

The people who can afford it run the risk of category confusion. All meaning dissolves through constant comparing up, in which they diminish what they have because there’s always someone with more. As one 30-something teacher ponders in an interview describing the luxury car and real estate she has acquired through her parents, “Am I a trust-fund baby, or are we middle class? I can’t even tell what middle class means in Manhattan.” Her parents still give her an allowance.

So Who Are These Subsidized Adult Children?

➺ 14 Nosy Conversations With People Whose Parents Give Them Money