Although it may not look like it when you walk into your artist friend’s Cobble Hill brownstone, there are limits to how much a parent can bestow on their child. Designed to thwart the wealthy’s attempts to circumvent the estate tax, which after death gobbles up to 40 percent of one’s assets over $13.99 million, the IRS’s “gift tax” stipulates that each taxpayer can give only $19,000 per year to any individual, including their kids. Any more than that and a parent must file Form 709, which alerts the IRS that the giver is eating into the lifetime maximum (which is also $13.99 million) they can grant to one person tax free. Yet rich parents often want to give more. Here are the (sometimes barely legal) ways they get it done.

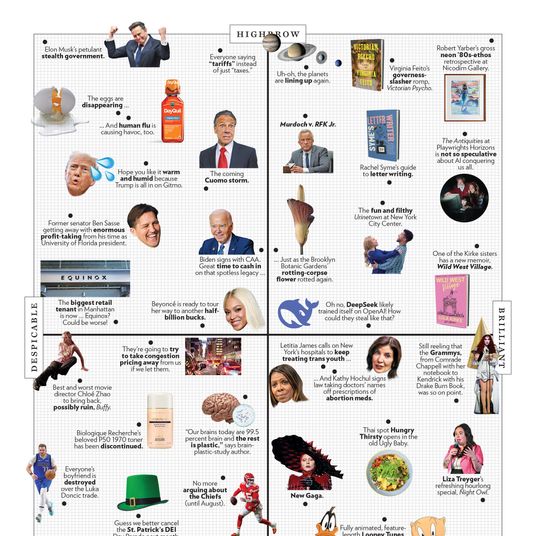

In This Issue

Establish a Trust

A trust distributes parents’ assets to a child according to conditions they set, and it can give parents control over how their assets are used, too. “You can add a spendthrift clause,” says Kitty Ritchie of Drucker Wealth, “so the child can only spend a certain amount of trust income per year, or an age-terminating clause, which says they’ll only get the funds at certain ages.” However, not every trust works as an estate-tax-mitigation strategy: An irrevocable trust is the only one that moves assets out of a parent’s estate without triggering estate taxes, she adds. But the money in it must still be less than the lifetime exemption threshold to avoid a gift tax.

Offer a Below-Market Loan

“Say you wanted to help your child buy an apartment,” says Avani Ramnani, managing director and partner at Francis Financial. “You say, ‘Here, I’m giving you a million dollars.’ But it must be a loan to avoid the gift tax. It must be documented, with terms and a promissory note, and carry an interest rate corresponding to the applicable federal rate, set by the IRS, which tends to be lower than what you would get in the market.” Fail to charge interest and the IRS will tax you on the earned income you should have received by doing so. It will also reclassify the loan as a gift. But unless you’re audited, it’s unlikely the IRS would figure out whether your child paid it back.

Get Creative With Mortgages

Finance expert Farnoosh Torabi is no stranger to parental support — it’s how she bought her first apartment. “If a child can’t get a mortgage themselves, a parent can buy their kid a place in cash,” she says. “Then, once the apartment is purchased, the child opens a home-equity line of credit, or HELOC (which is equal to 80 percent of the home’s value), pulls all the money out of that, and gives it back to their parents, which puts them most of the way back to where they started.” The child then refinances the HELOC into a fixed-rate mortgage in their own name. They’re now a homeowner, and their parents have most of their initial loan.

Cover Tuition

There are two kinds of transactions parents can pay on behalf of their kids without triggering the gift tax, as long as they make those payments directly to the relevant institution: education costs and medical expenses. “It’s the reason private K–12 schools have Grandparents’ Day,” says Ramnani. “Grandparents can also contribute to 529 plans, and while the amount is dictated by gift-tax rules, the gift grows tax free as long as it’s used for the approved expenses.” Roxana Reid, an educational consultant in New York, said that over the past five years, she has seen more grandparents reaching out than in her previous 16 years running her business. Another consultant, Dana Haddad, spent most of the aughts working in admissions at Horace Mann and Claremont Prep (now Léman Manhattan Preparatory School) and remembers years when up to a third of the students’ tuitions was paid by grandparents. Now, the same kind of grandparents shoulder her consulting fee, which is hundreds of dollars per hour. She’s constantly mediating generational differences between millennial parents who want the Mandarin-immersion program at Avenues and grandparents who want “the Trinitys, the Daltons, the Horace Manns, the Brearleys, the Collegiates, the Riverdales — what we call cocktail-party schools,” she says. “They love to brag about their grandkids, but they’d certainly prefer to brag about a school their friends have heard of.” In one case, Haddad had to help parents create a PowerPoint to convince their own skeptical parents of their choice.

Buy a Pied-à-Terre

Say you’re a parent who enjoys trips into the city, so you buy an apartment there. One you never sleep in. Your child does sleep in it, though. Every night. With their family. It’s a sneaky move, and it carries risk, says Ramnani. Letting an adult child live rent free in an apartment you own counts as a gift of the home’s fair-market rental value and thus should be disclosed. “If the building’s management notices you’re never there but your child is, it could be a problem,” Ramnani continues. But that’s fairly unlikely, admits Torabi: “I don’t know a single person who is reporting this kind of thing to the IRS.”

Pay Their Credit-Card Bill

It’s as simple as adding an authorized user to your Black Card — one phone call and your child has funds for daily expenses with you footing the bill. But Torabi points out that if your child makes more than $19,000 in charges per year, you’d need to report it as a gift. While an audit would certainly uncover such rule skirting, many parents are willing to take the risk.

Incorporate

“I had a client with two commercial properties,” says Andrew Crowell, vice-chairman of wealth management for DA Davidson & Co. “Rental income would come in each month, and she wanted to transfer it to her children, who she felt would be better off using it now rather than inheriting it later. So we put the real-estate holdings into an LLC, and she designated her children as partners.” When the rental income came in, they received the funds and paid tax on it as they would on any salary. This works only as long as the kids don’t own a part of the business as partners (which would be a gift).

Hire Your Child

If a parent owns a business, making their kid an employee is a canny gift-tax work-around. Crowell just warns that you can’t overpay — the IRS will flag egregiously inflated wages — nor can the child’s hiring be, as he puts it, “a wink and a nod.” But if you’re not bound by ethics, you could theoretically pay a child for scant work. “The vast majority of my clients’ kids who have this arrangement really do work at these jobs,” Crowell says. But for every industrious nepo hire, there are likely a handful of shiftless Roman Roys.

Give Undisclosed Cash

You can withdraw up to $10,000 at one time before your bank reports the transaction to the IRS, and if that stack should wind up in your kid’s possession, who’d be the wiser? Peter Anastasian, senior vice-president at Wealth Enhancement Group, squirms at this question: “Listen, that’s really going to be left to the individual. Does it happen? Certainly.”

So Who Are These Subsidized Adult Children?

➺ 14 Nosy Conversations With People Whose Parents Give Them Money