In most respects, Donald Trump’s signature legislative achievement was the opposite of tax reform. Traditionally, that phrase refers to a law that makes the tax code simpler, more economically efficient and progressive, and less vulnerable to abuse — all without losing any significant revenue.

The Trump tax cuts, by contrast, introduced immensely complicated rules for the taxation of closely held firms, provided bigger benefits to the passive owners of wealth (i.e. rentiers) than to laborers, delivered the lion’s share of its gains to the superrich, created a cornucopia of loopholes for well-heeled special interests to exploit, and is expected to add $1.9 trillion to the deficit in the coming decade.

And yet, despite their worst intentions, congressional Republicans did actually pull off a small — but significant — bit of genuine tax reform while ransacking the treasury for their paymasters: The Trump tax cuts shrunk the mortgage-interest deduction (MID) down small enough to drown in a McMansion’s backyard swimming pool.

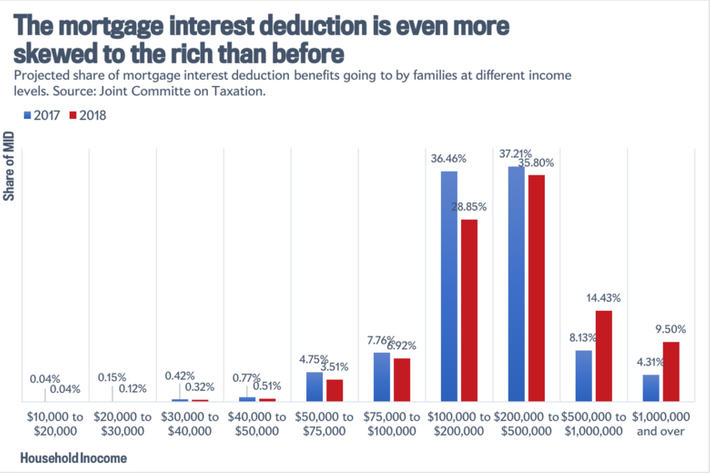

The MID is among the most regressive benefits in the tax code. In a nation where more than half-a-million people go homeless every night — and the public-housing system is plagued by a $49 billion repairs backlog — the mortgage-interest deduction effectively directed more than $50 billion of public funds into home-ownership subsidies for households that made over $100,00 a year in 2017.

But precisely because the deduction has delivered such enormous benefits to affluent and superrich Americans — who are disproportionately likely to vote, make political donations, and hold elected office — it has long been seen as politically untouchable, irrespective of the bipartisan consensus among economists for ending it.

Yet it’s now clear that the GOP tax bill touched the MID quite a bit: By doubling the standard deduction, Republicans dramatically shrank the number of households that will benefit from claiming individual tax breaks. As a result, the number of households that will subtract mortgage interest from their 2018 returns is expected to fall from 32.3 million in 2017, to just 13.8 million next year, according to a new report from Congress’s Joint Committee on Taxation. That drop in participation — combined with the new tax code’s lower cap on the amount of mortgage-debt interest that one can write off (down from $1 million in 2017 to $750,000 in 2018) — means that the deduction is expected to cost the government only $25 billion in 2018, down from $59.9 billion the year before.

As Slate’s Jordan Weissmann notes, these changes actually render the MID even more regressive than it was before. As the new standard deduction lures some upper-middle-class families away from itemizing, the deduction’s benefits will be even more disproportionately concentrated at the highest reaches of the income scale.

Now that the constituency behind the MID has grown smaller and less sympathetic — and fears that restricting the deduction would trigger a massive drop in home prices have been discredited — Weissmann argues that Democrats should kill it entirely the next time they take power. As a policy matter, this would make a good deal of sense: Democrats have a lot of ideas for increasing social-welfare spending, and ending regressive tax deductions would be a great way of generating revenue to support those investments.

But the politics of such a reform still look dicey. Today’s Democratic Party relies on the support of upper-middle-class voters — especially those who hail from high-cost housing markets. It was one thing for Republicans to modestly reduce the size of the MID while handing its beneficiaries a massive net tax cut. It will be another for a Democratic Congress to eliminate the deduction entirely, while also raising marginal rates on its beneficiaries to fund new social-welfare programs.

Which isn’t to say that the party would necessarily pay a major electoral price for killing the MID, but rather that it will (probably) be a big lift for the Democratic leadership to get congressional majorities behind killing welfare targeted at affluent homeowners in blue-state metros. After all, Democrats are already scrambling to undo the GOP’s cuts to the state-and-local-tax deduction, which serves the very same constituency. And given how much new revenue Democrats can generate just by restoring Obama-era tax rates on the superrich and corporations, odds are the party will avoid picking a fight with the blue-state bourgeoise.