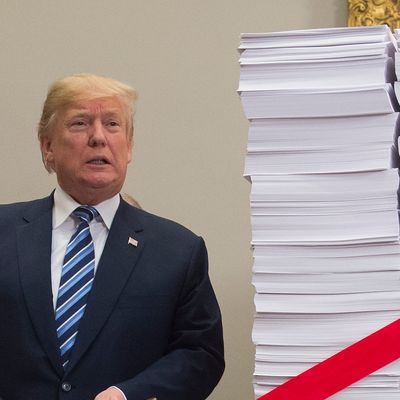

The House Ways and Means Committee released six years of former president Donald Trump’s tax returns Friday after a seemingly endless legal battle to obtain the documents and make them public — which, unlike all of his post-Watergate predecessors, Trump had repeatedly refused to do voluntarily and went to court to block Congress from doing instead. Anyone who wants to spend the holiday weekend reading thousands of pages from Trump’s personal and business federal tax returns from the years 2015 to 2020 can now download a zip file of them from the Ways and Means Committee’s website.

For those who don’t want to pore over the documents, it seems the key revelations were reported last week by the Joint Committee on Taxation. Among the major takeaways, the former president paid no federal income tax in 2020 after claiming business losses far greater than his income that year. Across the previous three years of his presidency, he paid a total of $1.1 million in federal income taxes on an adjusted gross income of $15.8 million — and he may not have had to pay any income tax at all if he was not subject to the Alternative Minimum Tax. In four of the six years, Trump reported a negative adjusted gross income. And according the JCT, the former president made a number of questionable claims in his taxes, including interest claims that may have disguised gifts to his children.

Following the release of the documents, Trump attacked Democrats for making them public and the U.S. Supreme Court for allowing it. “The ‘Trump’ tax returns once again show how proudly successful I have been and how I have been able to use depreciation and various other tax deductions as an incentive for creating thousands of jobs and magnificent structures and enterprises,” he said in a statement. (Republicans have already vowed to retaliate when they take control of the House in 2023, threatening to release Hunter Biden’s tax returns.)

As Richard Neal, the outgoing Democratic chairman of Ways and Means Committee, has emphasized, the Internal Revenue Service failed to audit Trump during the first two years of his presidency. The IRS began taking a closer look at Trump’s tax returns only after Democratic lawmakers started probing the agency once they retook control of the House in 2019.

There is some new information revealed in the documents made public Friday, according to journalists and experts who have begun digging into them. For instance, Trump did not make any charitable donations in 2020, which suggests he broke his promise to donate his $400,000 annual salary as president to charity, at least for that final year. Per the Associated Press, his charitable donations were inconsistent across the six years:

The documents show that Trump’s charitable donations fluctuated during his presidency but, in his final years, represented only a sliver of his income. In 2020, the year the coronavirus ravaged the economy, Trump reported no charitable donations at all. In 2019 and 2018 he reported writing checks for about $500,000 in donations. In earlier years the numbers were higher — $1.8 million in 2017 and $1.1 million in 2016. It’s unclear whether the reported sums included Trump’s $400,000 annual presidential salary, which he had said he would forgo and claimed he donated to various federal departments.

The returns also indicate that Trump had bank accounts in foreign countries, as the Washington Post notes:

Trump said in his tax filings that he had completed paperwork required of any American who has a financial account in another country worth more than $10,000. At various times, he said, he had such accounts in China, Ireland, the United Kingdom and St. Martin.

And as CNN points out, the returns also reveal a multitude of business dealings abroad:

On his tax return, Trump listed business income, taxes, expenses or other notable financial items from or in Azerbaijan, Panama, Canada, India, Qatar, South Korea, the United Kingdom, China, the Dominican Republic, United Arab Emirates, the Philippines, Grenada, US territory Puerto Rico, Georgia, Israel, Brazil, St. Maarten, Mexico, Indonesia, Ireland, Turkey and St. Vincent. But the tax returns don’t explain what business ties he had in those countries and with whom he might have been working while he was president.

According to New York Times’ ongoing analysis, while it’s not clear how much impact the massive tax cuts Trump signed in 2017 ultimately had on his own taxes, the law’s cap on the deductions allowed for payments made for state and local taxes may have hurt him financially:

The so-called SALT deduction disproportionately hit higher earners, including Mr. Trump, in high-tax cities and states like New York. In 2019, he reported paying $8.4 million in state and local taxes. Because of the SALT limits included in his tax law, he was able to deduct only $10,000 of those taxes paid on his federal income tax return. Those losses could have been mitigated at least in part by other sections of the law that were favorable to wealthier taxpayers like Mr. Trump.

The Times also notes that the returns reveal that Trump’s longtime accounting firm, Mazars USA, began parting ways with him and his businesses as early as 2020. The firm didn’t announce it had ceased doing business with Trump until this year.

This post has been updated.